Beneficial Ownership Information (BOI)

Beneficial Ownership Information Resources

The Corporate Transparency Act (CTA), enacted in 2021 and administered by FinCEN, requires reporting of beneficial owners’ information (BOI) from companies, including small businesses. The intent of the legislation is to combat money laundering, tax evasion and other financial crimes. Steep civil and criminal penalties await willful noncompliance. Reporting forms became available on Jan. 1, 2024 with deadlines determined by the date a company was established.

Helpful resources

- Risk Management and the Corporate Transparency Act (including sample engagement letter)

- FinCEN BOI Compliance Guide

- Beneficial Ownership Information Reporting Rule Fact Sheet

- BOI Reporting - FinCEN website

- BOI Filing website

- AICPA BOI reporting resources

- ISCPA joins in BOI legislation delay request

What is the CPA's role?

Questions surrounding the CPA's role in assisting clients with BOI reporting remain. As clients ask their trusted advisors for guidance, please know there is still much debate on who should accept the responsibility for the new CTA reporting.

The AICPA and CIMA have expressed preliminary concerns. Debate persists on whether non-attorney practitioners advising clients on the new BOI reporting form could be considered an unauthorized practice of law (UPL).

This leaves CPAs in a difficult position, and AICPA and CIMA recommend contacting state regulators, insurance carriers, and legal counsel to further address this issue. They also advise considering whether to address this matter in client engagement letters to clearly state if you will perform CTA reporting services.

ISCPA has been actively looking for answers to the UPL questions for CPAs in Iowa and will share information as it becomes available.

Some additional resources relating to UPL and CPAs on BOI reporting.

- CNA Coverage Statement on CTA

- Oh BOI: The Corporate Transparency Act and CPA firms, Journal of Accountancy

- AON Risk Alert on Beneficial Ownership Reporting

- Podcast from AICPA & CIMA titled Traversing the beneficial ownership information reporting requirements.

What is a “reporting company”?

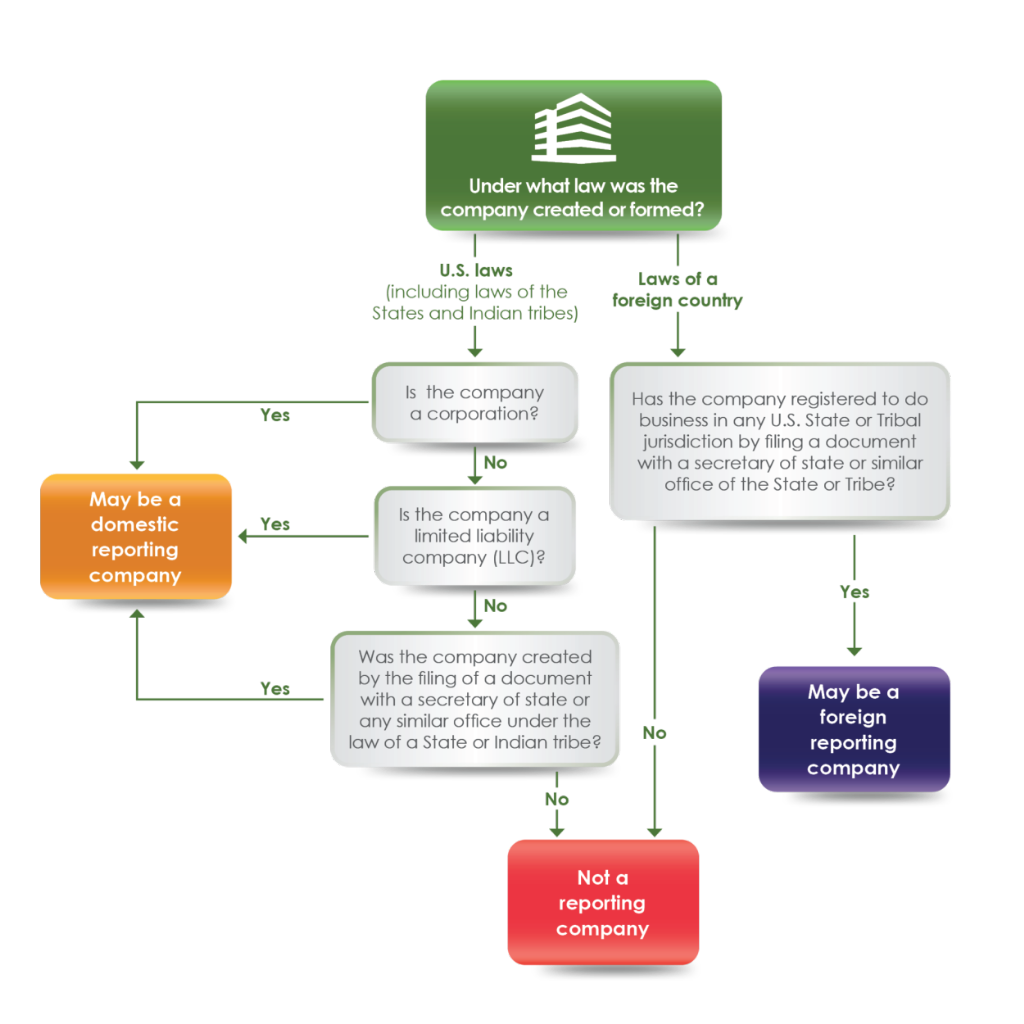

The Reporting Rule requires that all “reporting companies” file BOI reports with FinCEN within specified timeframes. A reporting company is any entity that meets the “reporting company” definition and does not qualify for an exemption. There are two categories of reporting companies: a “domestic reporting company” and a “foreign reporting company”. If your company is neither a “domestic reporting company” nor “foreign reporting company” because it does not meet either definition (as described below) or it qualifies for an exemption, then it is not required to file a BOI report with FinCEN. The following chart shows how to analyze whether your company is a “reporting company”.

When should my company file the BOI report?

If your company already exists as of January 1, 2024, it must file its initial BOI report by January 1, 2025. If your company is created or registered to do business in the United States on or after January 1, 2024, and before January 1, 2025, it will have 90 calendar days after receiving actual or public notice that the company’s creation or registration is effective to file its initial BOI report. Specifically, this 90-calendar day deadline runs from the time the company receives actual notice that its creation or registration is effective, or after a secretary of state or similar office first provides public notice of its creation or registration, whichever is earlier. If your company is created or registered on or after January 1, 2025, it will have 30 calendar days from actual or public notice that its creation or registration is effective to file its initial BOI report. For example, your company may receive actual notice that its creation or registration is effective through a direct communication from the secretary of state or similar office. Your company could also receive public notice that its creation or registration is effective because it appears on a publicly accessible registry maintained by the secretary of state or similar office. Notice practices will vary by jurisdiction. If a jurisdiction provides both actual and public notice, the timeline for when an initial BOI report is due starts on the earlier of the two dates notice is received.